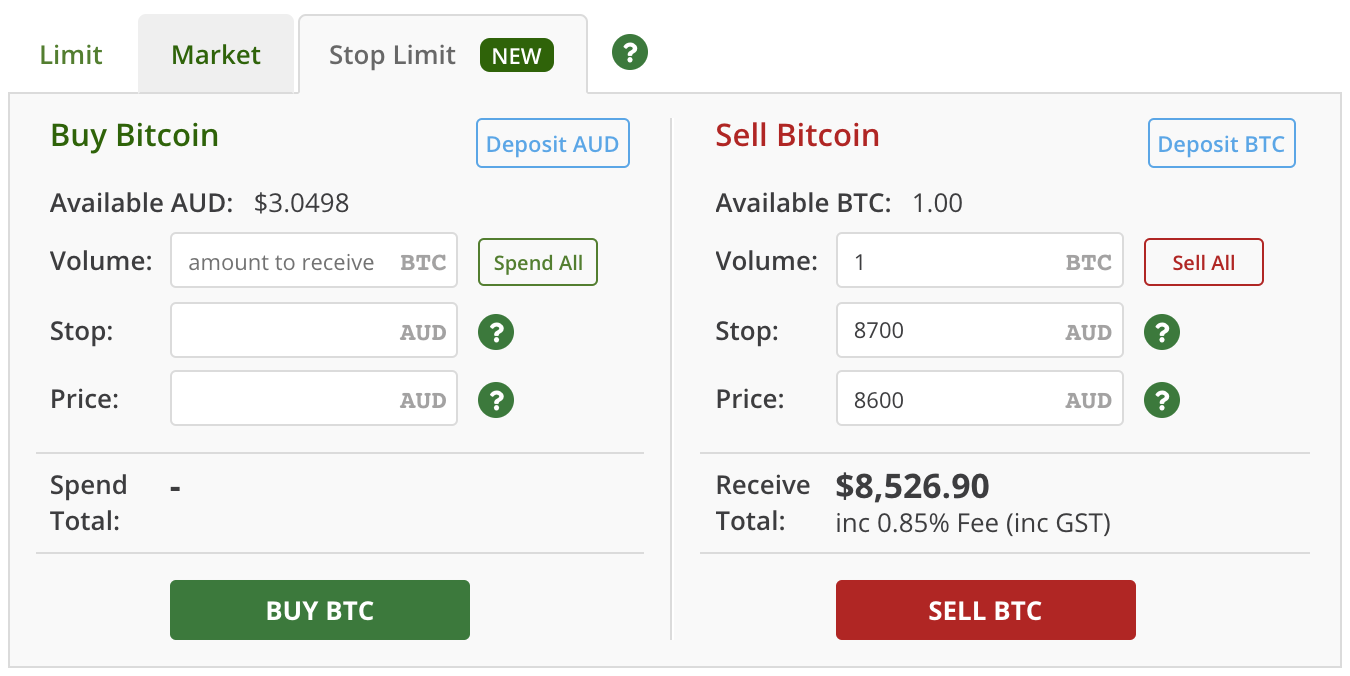

So, if the market price falls to USD your long position will be closed. Chat directly with one of our client engagement specialists about your specific needs Chat Now Like what you see? However, you want to limit your losses on this long position so you set the Stop Price with a negative offset of USD. You can specify the buy Stop Price in three ways: 1. Not all stop orders are called stop orders, not all exchanges use the terms marker and taker, etc.

Most Popular Articles Like This One

Mobile App notifications. Email Notifications. The price is showing positive signs We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each. Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing. Breaking News.

Still can’t find a solution to your problem?

Stop orders , which are orders to buy or sell a security once it reaches a certain price, can help bitcoin investors lock in gains or limit losses. These orders can make it easier for you to meet your investment objectives by automating trades and can be thought of as insurance to help increase your chances of buying or selling at the exact price you want. For example, you can use a stop order to buy bitcoin once it rises to a predetermined price. Alternatively, one of these orders can sell the digital currency when its price falls to a certain level. By setting up automated transactions, stop orders can take emotions out of the equation, a feature that can prove highly beneficial during times of market turmoil or irrational exuberance. Keeping your emotions under control is crucial to succeed as a trader over the long-term. One major distinction you should know is the difference between stop-market orders and stop-limit orders.

The Basic of the Order Book, Fees, and Maker/Taker

Stop orderswhich are orders to buy or sell a security once it reaches a certain price, can help bitcoin investors lock in gains or limit losses. These orders can make it easier for you to meet your investment objectives by automating trades and can be thought of as insurance to help increase your chances of buying or selling at the exact price you want. For bitcoin buy stop price, you can use a stop order to buy bitcoin once it rises to a predetermined price.

Alternatively, one of these orders can sell the digital currency when its price falls to a certain level. By setting up automated transactions, stop orders can take emotions out of the equation, a feature that can prove highly beneficial during times of market turmoil or irrational exuberance. Keeping your emotions under control is crucial to succeed as a trader over the long-term. One major distinction you should know is the difference between stop-market orders and stop-limit orders.

In the case of the first, a market order is entered when a security reaches a specific price. Limit orderson the other hand, are designed to set a maximum price for what an investor is willing to pay when buying or a minimum price the investor will accept when selling.

If it breaks out of its current trading range and starts climbing, you want to purchase it to benefit from the rally. One factor that can have a huge impact on the usefulness of both market and limit orders is volatility.

During times of volatility, the prices secured by market orders could vary quite a bit. By setting up buy market orders, you could end up purchasing bitcoin at a higher price than you originally desired. Using a stop-market order to cap losses could produce similar results.

By using one of these orders to limit downside, you could end up selling your bitcoin for significantly less than you originally wanted to and therefore incurring a loss that is outside your comfort zone. While stop-market orders can result in a wide range of purchase and sale prices, stop-limit orders might not execute at all if your price conditions cannot be met during the time frame when the order remains open.

If bitcoin prices are too volatile, or if the difference between the bid and ask is too large, a limit order may fail to fill, preventing you from purchasing bitcoin in your desired price range or exiting a position with a reasonable loss.

If you decide to use stop orders in your bitcoin investing, there are several tips and tricks you can use. If you are just getting started using stop orders, you may be better off sticking with market ordersas these are easier to set up and also more likely to get filled. Another helpful tip is to set up your stop levels at major price levels. Never assume that your stop order has been processed successfully. Instead, be sure to monitor your account until you know that the order you place has gone.

Discipline is a key part of being a successful trader. To thrive as a trader requires a plan and the ability to stick to it. Countless articles have spoken to the importance of having the right attitude and staying disciplined. By using stop orders to cap losses and take profits, you could form one crucial part of a trading strategy. If you stick to this strategy over the long haul, you could build up some consistency over time.

As a trader, you can benefit from reviewing your performance from time to time. One particular aspect you could review is the efficacy of your stop orders. Doing so will help you determine how successful you are at using these orders to meet your investment objectives and whether or not you require any change in strategy. Stop orders can help you minimize losses or lock in gains.

By using these orders, you are basically employing an insurance product that can help you proactively manage risk. Keep in mind that there are different kinds of stop orders, and they come with their own unique costs and benefits. Since using stop orders effectively can require knowledge of complex information, be sure to do your research before placing.

For additional helpful bitcoin buy stop price on bitcoin investing, subscribe to Bitcoin Market Journal. Join the Bitcoin Market Journal newsletter and get objective coverage of bitcoin, altcoins, and ICOs from our trusted analysts.

Kinds of Stop Orders One major distinction you should know is the difference between stop-market orders and stop-limit orders. Market Orders In the case of the first, a market order is entered when a security reaches a specific price.

Limit Orders Limit orderson the other hand, are designed to set a maximum price for what an investor is willing to pay when buying or a minimum price the investor will accept when selling. Volatility One factor that can have a huge impact on the usefulness of both market and limit orders is volatility. Tips and Tricks If you decide to use stop orders in your bitcoin investing, there are several tips and tricks you can use. Stick With Market Orders If you are just getting started using stop orders, you may be better off sticking with market ordersas these are easier to set up and also more likely to get filled.

Monitor Your Stops Never assume that your stop order has been processed successfully. Building Discipline Discipline is a key part of being a successful trader. Evaluate Your Performance As a trader, you can benefit from reviewing your performance from time to time. Summing It Up Stop orders can help you minimize losses or lock in gains.

How Many People Use Bitcoin in ? Top 7 Litecoin Wallets, Rated and Reviewed for Receive Free E-mail Updates. You should. Sign Up.

How Much was 1 Bitcoin Worth in 2009?

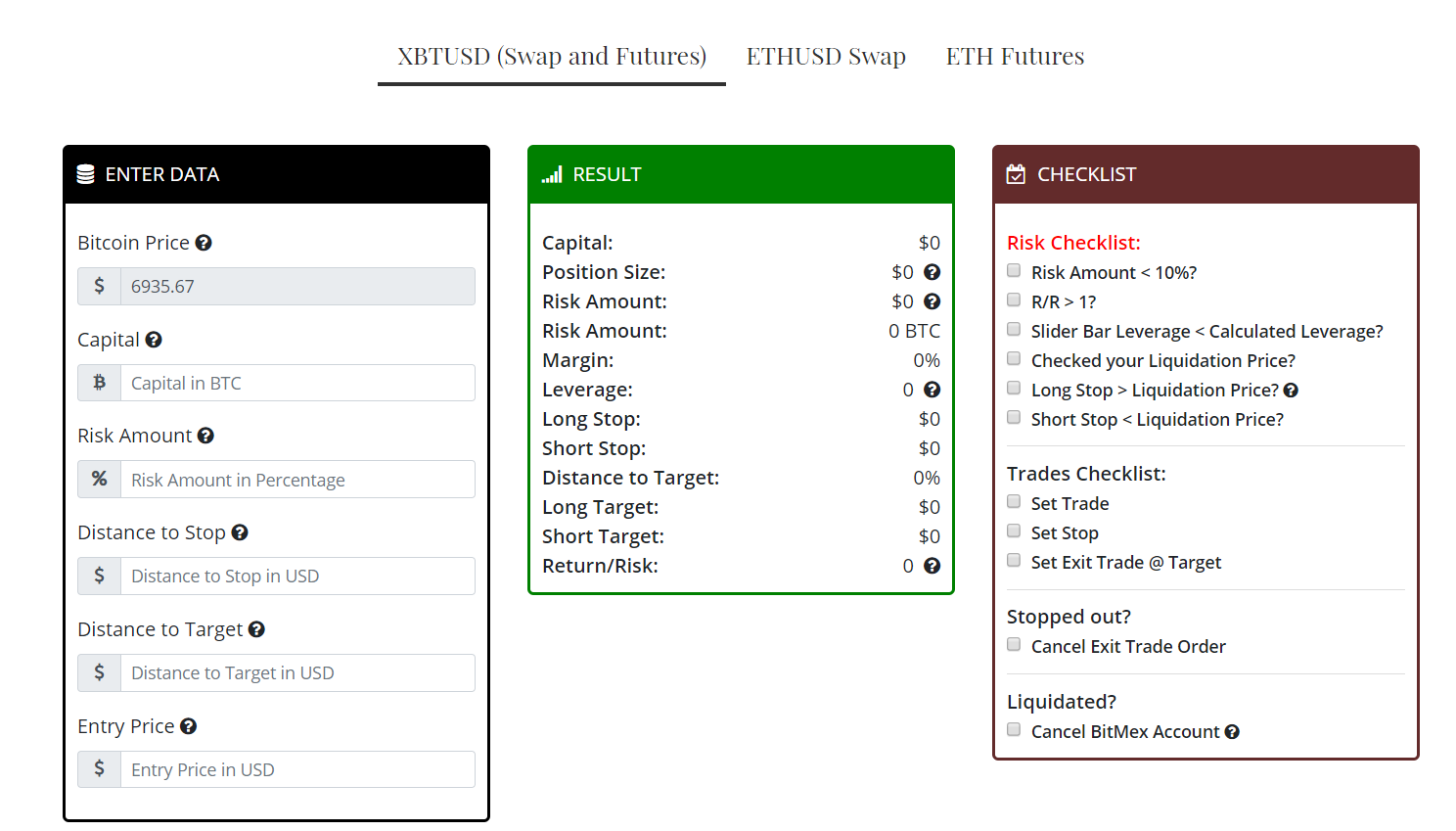

Chat directly with one of our client engagement specialists about your specific needs Chat Now Like what you see? XBT touches a specified price, known as the Stop Price. You’re holding your ABC, but if its price goes down, your ABC will automatically be sold as long as there are enough buy orders at or above 0. You can set a market buy or market sell. If this is all too much to remember, just try entering some numbers bitcoin buy stop price the stop-limit box and clicking «Buy» or «Sell. So it works like a limit order, in that it goes on the books, but it executes like a market order once that price is reached as a rule of thumb, there are stops that use limits. Positive offset from the current market price. What is a Stop Loss order? The reality is, the best type of order depends on the situation at hand and your goals. For example, if you would like the system to automatically sell your ABC once it reaches a certain price, place a stop-limit order with these parameters:. What you do is, for example, set Ether to sell to Bitcoin if Bitcoin goes down or Ether up, and Ether to Bitcoin if Bitcoin goes down or Ether goes up.

Comments

Post a Comment