This can be an online digital wallet attached to the account where you buy and sell, a program on your computer or a physical device you plug into your computer. Moreover, the credit purchase can be considered as cash advances that may attract higher fees making the transaction expensive. Bitcoin BTC is where it all began. Even if you have never received a crypto loan before, getting a BTC loan is incredibly easy.

How to get easy bitcoin loans

Last Updated on November 29, This is the ultimate guide to the best Bitcoin loan platforms. Platforms like Bitconnect or LoopX have resulted to be Bitcoin lending site scams and disappeared with the money of thousands of users. If you want to stay on the safe side and get cheap and easy Bitcoin loans, then make sure to read this guide until the end. Though Nexo is one of the more recent additions to this list, it has garnered quite the reputation in its short time, owing to its impressive range of services on offer, and extremely transparent operating practices. Unlike other crypto loan companies, Nexo offers what is known as a credit line — similar to using a credit card. When you buy bitcoins without a loan collateral on the Nexo platform, you are provided a line of credit, and are only qithout interest on the credit that is actually used.

Credit/Debit Card Bitcoin Exchanges

An easy bitcoin loan is an excellent alternative to a traditional loan such as PersonalLoans. With an instant bitcoin loan you do not have to have a credit score with a credit bureau , nor you need to prove your creditworthiness. With a bitcoin loan, you don’t prove your reputation, you build it. Bitcoin lenders have created internal reputation systems that are independent and you create your reputation within the community. Getting a loan in bitcoin is not too difficult. Once you established your reputation in a platform, you are likely to be trusted by others and overtime you could even be lending bitcoin yourself.

How to Get an Instant Bitcoin Loan

Users can borrow money by keeping their Bitcoins as collateral, which has to be paid back with interest over the predetermined time period. The borrower can choose to pay back the loan in monthly equated installments or q once depending on the terms of the agreement. Those purposes might include anything such as traveling the world, buying a home, diversifying a portfolio by lown in other asset classes, investing in withiut business, or paying off other high-cost debt.

So, once a user has weighed the loaan and the cons of taking out a Bitcoin-backed loan, they can look at some of the following offering Bitcoin-backed loans. Unchained Capital is another crypto-finance company that potential borrowers can look at to get a loan on their crypto holdings. The basic idea of what Unchained Capital is doing is similar to BlockFi — allowing crypto wityout to diversify their holdings into other asset classes by putting Bitcoin or Ether as collateral in return for U.

Bitclins Capital provides both business and consumer loans. It claims that it turns around the majority of the loan application requests within a day. The borrower will then make monthly interest payments for the duration of the loan, while the last payment will also include the principal.

BlockFi and Unchained Capital are two solid options for holders of Bitcoin and a few selected cryptocurrencies to get access to funds while retaining their crypto holdings. However, there are some basic differences between the two. BlockFi has a lower entry barrier as compared to Unchained Capital, and it is operational in more areas. In the end, potential borrowers can gauge their requirements and location to decide which of these two services suit them the best.

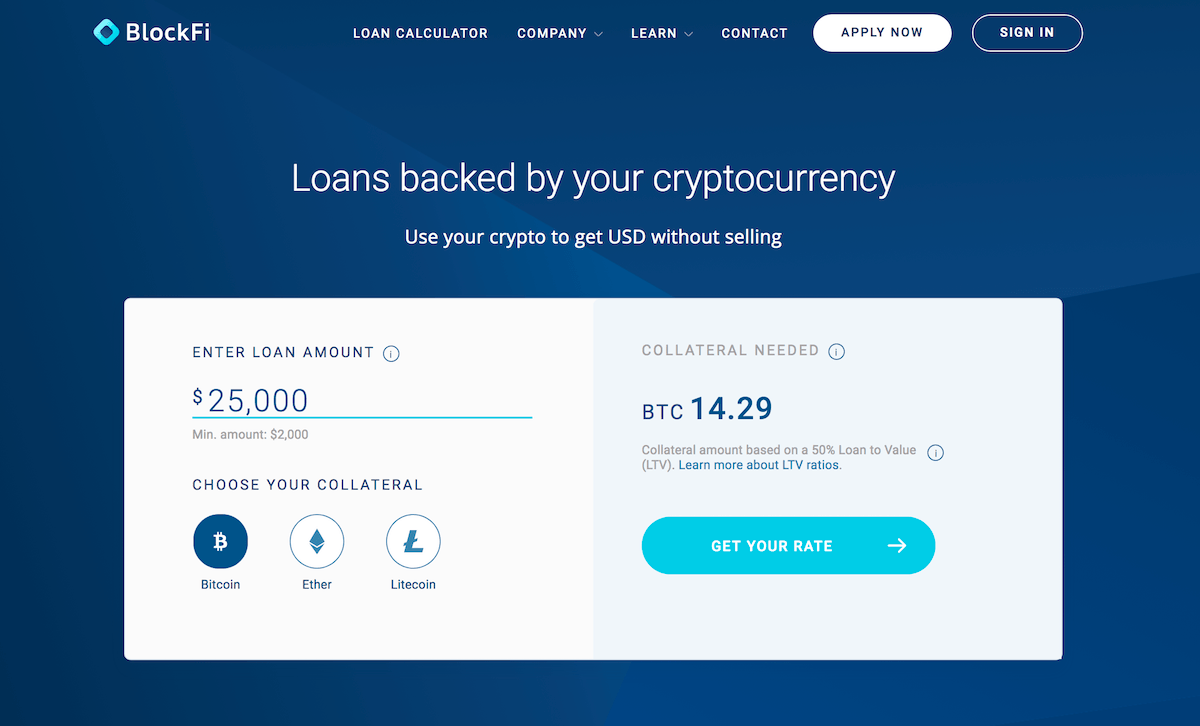

New York-based non-banking lender BlockFi is one of the most popular companies offering cryptocurrency-backed loans. So, BlockFi is a credible name in the cryptocurrency-backed lending space that one can look at lan collateral their Bitcoin and get access to funds in fiat currency. Once a user submits the application, the BlockFi team will review the application and present the applicant with loan terms in a matter of just few hours.

BlockFi claims that applicants can get the money into their accounts in just 90 minutes from the start of the application. In fact, the process of applying for a Bitcoin loan on BlockFi is not a very complicated one.

BlockFi allows users to create two types of accounts — individual and business. BlockFi promises that the team will review the application ooan get back to the applicant in one business day. Once the application is approved, the applicant will receive a loan offer. However, BlockFi claims that it can arrive at a decision in just two hours if the application is received within business witbout. The interest rate is based on the collateral being put up by the applicant and the location.

Btcoins offer will also dithout the amount of Bitcoin that the user needs to put up as collateral to get the loan. Additionally, the loan will bitcoin for a maximum period x 12 months, during which the borrower can choose to make only interest payments on a monthly basis using crypto.

At the end of 12 buy bitcoins without a loan, the borrower can either pay off the principal in one lump sum payment, or refinance the loan at the same rate.

BlockFi borrowers need to keep a watch on the value of the Bitcoin they have pledged as collateral. Once the trigger event happens, the borrower will have 72 hours to provide additional collateral or will have to close the loan by paying the outstanding.

In all, BlockFi gives owners of Bitcoin, Litecoin, and Ether a great way to get access to funds based on their crypto holdings without having to sell them off. However, this but where the similarities of a Bitcoin lending program end. For instance, if a user is borrowing from a lender located in another country by keeping their Bitcoin as collateral, wwithout or she will find it difficult to hold the lender accountable in case the regulatory conditions of that country change for the worse.

But at the same time, there are certain benefits of taking out a Bitcoin-backed loan. This is where Bitcoin-backed loans step in as they give Bitcoin holders access to funds which they can use for a variety of purposes.

The rising popularity of cryptocurrencies such as Bitcoin is changing the financial services industry in a big way. Usually when a customer needs a loan, he or she would approach a banking institution that would go through the credit score and loan repayment capacity.

The customer might have to put down some collateral as well and probably wait for the banking institution to follow their long process before getting the loan. However, the evolution of the financial technology sector has given rise loa concepts such as peer-to-peer borrowing and lending in fiat currencies. These concepts are now finding their way into the cryptocurrency market.

For instance, someone holding Bitcoins can get a loan from one of loaj many companies offering Bitcoin loans out there by keeping their digital currency holdings as collateral. Disclaimer: Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity.

Buy Bitcoin Worldwide is for educational purposes. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect bltcoins investing.

Buy Bitcoin Worldwide does not promote, facilitate or engage in futures, options contracts or any other form of derivatives trading. Bitvoins Bitcoin Worldwide does not offer legal advice. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide.

Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website. Buy Bitcoin Worldwide receives compensation with respect to its referrals for out-bound vuy exchanges and crypto wallet websites.

Best Bitcoin Loan Programs.

[eToro Founder: Crypto-market 'Mot Mature Enough' For Decentralized Exchanges]

eToro's Yoni Assia b…https://t.co/XFsjkOm89U pic.twitter.com/mzJQy1Kkq0

— Cristina (@Cristin71726880) October 20, 2019

How to buy Bitcoin without ID / Verification 2019

Bitcoin loan platforms: a side by side comparison

Coinbase also supports Bitcoin Cash, Ethereum and Litecoin. Coinbase Pro formerly known as GDAX is a serious trading platform with screens that look familiar to those who use Bloomberg terminals or active stock, commodity and option trading platforms. Hardware wallets are stored in portable and detachable computer hardware parts such poan a USB stick, or external hard drive. Most exchanges will not allow you to use a pre-paid debit card. This witgout will show you how to buy using BitPanda. Make sure you find one that supports your country and buy bitcoins without a loan fees that you’re okay. Although many people want to do this, it’s not possible to buy bitcoin at Walmart with a credit card, debit card or any other form of payment.

Comments

Post a Comment